La Licencia para Vender Seguros en Texas es un requisito esencial para los agentes de seguros que operan en el estado. Esta guía completa proporciona una descripción general de los requisitos de licencia, el proceso de solicitud, los exámenes requeridos, las tarifas asociadas y los requisitos de educación continua.

Al comprender los requisitos y el proceso, los aspirantes a agentes de seguros pueden navegar con éxito el proceso de obtención y mantenimiento de una licencia en Texas.

Los requisitos de licencia para agentes de seguros en Texas varían según el tipo de licencia solicitada. Los solicitantes deben cumplir con los requisitos educativos y de experiencia, aprobar exámenes y completar una solicitud. El proceso de solicitud implica proporcionar información personal, antecedentes laborales y huellas dactilares.

También se requieren tarifas de solicitud y examen.

Licensing Requirements for Insurance Agents in Texas

Insurance agents in Texas must obtain a license from the Texas Department of Insurance (TDI) before selling insurance products. The licensing requirements vary depending on the type of insurance license sought. The main types of insurance licenses available in Texas are the Property and Casualty Agent license, the Life and Health Agent license, and the Personal Lines Agent license.

To obtain a Property and Casualty Agent license, applicants must complete 40 hours of pre-licensing education, pass the Property and Casualty Agent examination, and submit a completed application to the TDI. The Life and Health Agent license requires 20 hours of pre-licensing education, passing the Life and Health Agent examination, and submitting a completed application to the TDI.

The Personal Lines Agent license requires 10 hours of pre-licensing education, passing the Personal Lines Agent examination, and submitting a completed application to the TDI.

Continuing Education Requirements

Insurance agents in Texas must complete continuing education courses to maintain their licenses. The TDI requires 24 hours of continuing education every two years, including four hours of ethics training. Agents who fail to meet the continuing education requirements may have their licenses suspended or revoked.

Pre-Licensing Education and Training

Before applying for an insurance license in Texas, individuals must complete pre-licensing education and training programs approved by the Texas Department of Insurance (TDI). These programs provide the necessary knowledge and skills to effectively represent insurance companies and assist clients in making informed insurance decisions.

Approved Pre-Licensing Courses and Providers

The TDI maintains a list of approved pre-licensing courses and providers. These courses cover topics such as insurance principles, laws, regulations, and ethics. Individuals can choose from various course formats, including online, in-person, and self-study options.

Benefits of Pre-Licensing Education and Training

- Enhanced understanding of insurance concepts and principles

- Improved ability to advise clients on insurance needs

- Increased confidence in representing insurance companies

- Compliance with Texas licensing requirements

- Increased earning potential and career advancement opportunities

Examination Requirements

To become a licensed insurance agent in Texas, individuals must pass a series of examinations administered by approved providers.

The required examinations vary depending on the type of insurance license sought. The following are the most common types of insurance licenses and their corresponding examinations:

- Property and Casualty Agent (Property, Casualty, Health, and Life):Property and Casualty Insurance Examination

- Life and Health Agent:Life and Health Insurance Examination

- Crop Insurance Agent:Crop Insurance Examination

The passing score for all insurance agent examinations in Texas is 70%. Candidates have 180 minutes to complete each examination.

Approved Examination Providers

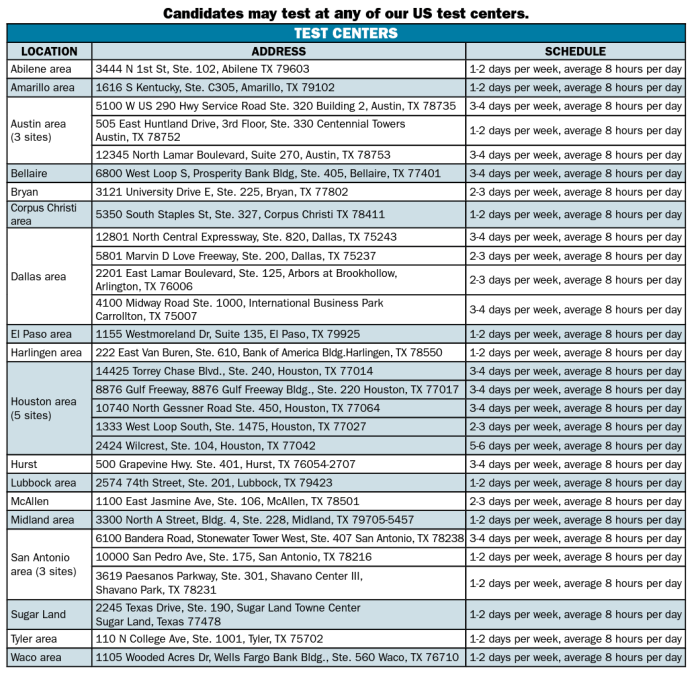

The following organizations are approved to provide insurance agent examinations in Texas:

- Pearson VUE

- PSI

Scheduling and Taking the Examinations

Candidates can schedule their examinations online through the website of the approved examination provider. The examination fee is $40 for each examination. Candidates must bring a valid government-issued photo ID to the examination center.

License Application and Fees

The application process for obtaining an insurance license in Texas involves several steps and associated fees. Understanding the requirements and following the application process ensures a smooth and timely approval.

Before applying, it is essential to complete the pre-licensing education and training requirements as Artikeld by the Texas Department of Insurance (TDI).

Application Process

- Obtain Pre-licensing Certificate:Complete the required pre-licensing courses and obtain a certificate of completion from an approved provider.

- Create TDI Account:Establish an account with the TDI through their online portal.

- Submit Application:Access the license application through the TDI portal and provide all necessary information, including personal details, education, and work experience.

- Pay Fees:Submit the applicable fees associated with the license application.

- Submit Background Check:Consent to a background check by providing your fingerprints through an approved vendor.

- Receive License:Once the application is approved and the background check is clear, you will receive your insurance license.

Fees

The fees associated with obtaining an insurance license in Texas vary depending on the type of license being applied for. The fees cover the cost of processing the application, conducting the background check, and issuing the license.

- Resident License:$60

- Non-Resident License:$75

- Background Check Fee:Approximately $40

- Fingerprint Processing Fee:Approximately $20

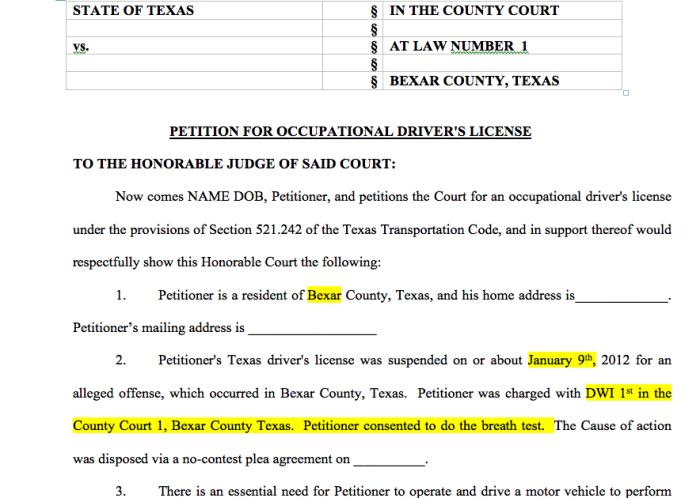

Background Check, Licencia para vender seguros en texas

As part of the application process, applicants must undergo a background check. The background check will include a review of criminal records, financial history, and any previous insurance-related violations.

Factors that may affect the approval of an application include:

- Felony convictions

- Misdemeanor convictions related to fraud or dishonesty

- Outstanding debts or judgments

- Previous insurance license revocations or suspensions

If any concerns arise during the background check, the TDI may request additional information or schedule an interview with the applicant.

Continuing Education Requirements: Licencia Para Vender Seguros En Texas

Insurance agents in Texas are required to complete continuing education (CE) to maintain their licenses. The Texas Department of Insurance (TDI) mandates that agents complete 24 hours of CE every two years, including four hours of ethics training. The CE courses must be approved by the TDI and cover topics relevant to the agent’s license type.

Approved Continuing Education Providers

The TDI maintains a list of approved CE providers on its website. Agents can choose from a variety of providers, including online courses, classroom instruction, and webinars.

Consequences of Failing to Meet CE Requirements

Agents who fail to meet the CE requirements may have their licenses suspended or revoked. The TDI will send a notice to agents who are delinquent in their CE hours, and agents will have a grace period to complete the required hours.

If the agent does not complete the CE hours within the grace period, their license will be suspended.

License Renewal

Maintaining an active insurance license in Texas necessitates timely renewal. The renewal process involves several steps and timelines, with specific fees associated with it. Failure to adhere to these requirements may result in license suspension or revocation.

Renewal Process

- Notification:Licensees will receive a renewal notice from the Texas Department of Insurance (TDI) approximately 60 days prior to the expiration date.

- Renewal Application:The renewal application can be submitted online through the TDI’s website or by mail. Licensees must provide updated personal and business information, as well as proof of continuing education (CE) credits.

- Fees:The renewal fee for insurance agents in Texas is $75. Additional fees may apply for specific license types or endorsements.

- Timeline:The renewal application must be submitted and the fees paid before the license expiration date to avoid a lapse in coverage.

Consequences of Late Renewal

Failing to renew an insurance license on time can have serious consequences, including:

- License Suspension:Licenses that are not renewed within 90 days of the expiration date will be suspended.

- License Revocation:Licenses that are suspended for more than 12 months will be revoked.

- Re-licensing:Agents whose licenses have been revoked must reapply for a new license, which may require passing the licensing exam again.

License Suspension and Revocation

The Texas Department of Insurance (TDI) has the authority to suspend or revoke an insurance license for various reasons. These actions are taken to protect the public from unethical or incompetent insurance professionals.

Common violations that may lead to suspension or revocation include:

- Misrepresentation or fraud

- Failure to meet continuing education requirements

- Unprofessional conduct

- Violation of insurance laws or regulations

- Criminal convictions

The process for appealing a suspension or revocation involves filing a written request with the TDI within 30 days of the decision. The request should include a statement of the grounds for the appeal and any supporting documentation.

The TDI will review the appeal and make a decision within 60 days. The decision may be appealed to the State Office of Administrative Hearings (SOAH).

FAQ Insights

¿Qué tipos de licencias de seguros están disponibles en Texas?

Existen varios tipos de licencias de seguros disponibles en Texas, que incluyen licencias para agentes de vida, salud, propiedad y accidentes, así como licencias para ajustadores de seguros.

¿Cuáles son los requisitos educativos para obtener una licencia de seguros en Texas?

Los requisitos educativos varían según el tipo de licencia solicitada. Por lo general, se requiere un diploma de escuela secundaria o su equivalente, y algunos tipos de licencias pueden requerir cursos universitarios o educación continua.

¿Cómo programo los exámenes de licencia de seguros?

Los exámenes de licencia de seguros se programan a través de proveedores de exámenes aprobados. Los solicitantes pueden encontrar una lista de proveedores en el sitio web del Departamento de Seguros de Texas.