In cell c8 create a formula using the pv function – In cell C8, create a formula using the PV function, embarking on a journey that unravels the mysteries of financial analysis. The PV function, a powerful tool in Excel’s arsenal, empowers users to calculate present values, providing invaluable insights into investment decisions, loan repayments, and annuity valuations.

Delve into the intricacies of the PV function, understanding its purpose, arguments, and significance. Explore the practical applications of this function, unlocking its potential to transform financial decision-making. Master the art of formula creation in cell C8, gaining the ability to harness the PV function’s capabilities.

Overview of the PV Function: In Cell C8 Create A Formula Using The Pv Function

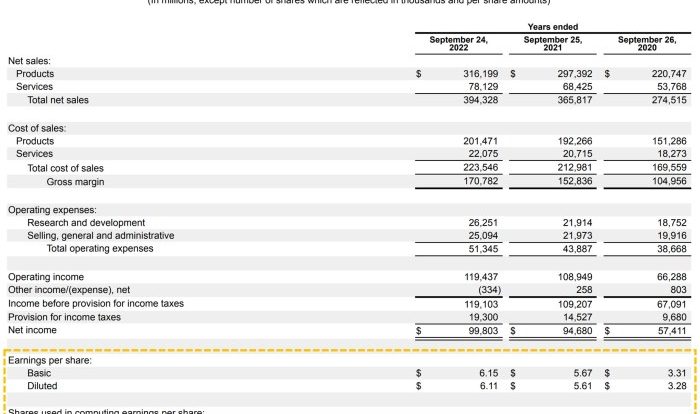

The PV function in Excel is a financial function used to calculate the present value of a series of future cash flows. It is commonly used in financial analysis and planning to determine the current worth of future income streams, such as investments, loans, or annuities.

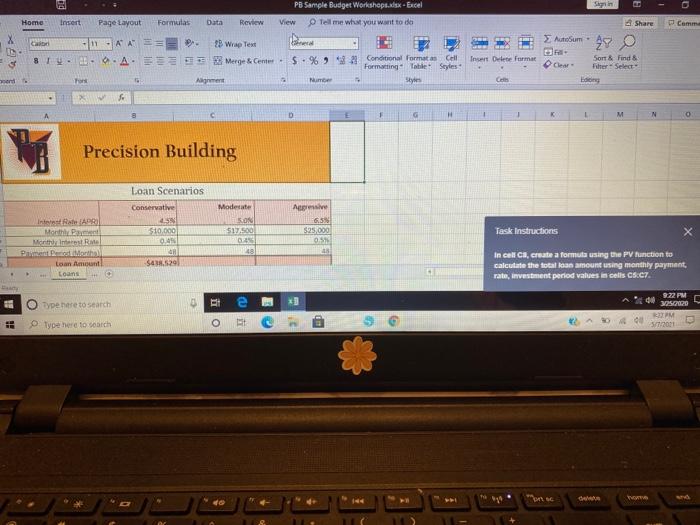

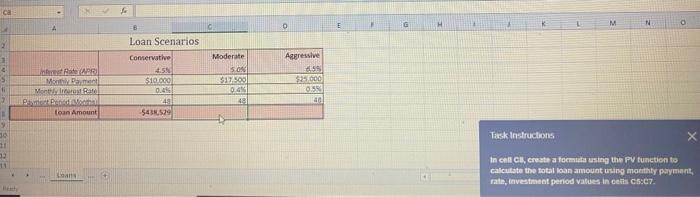

Formula Creation in Cell C8

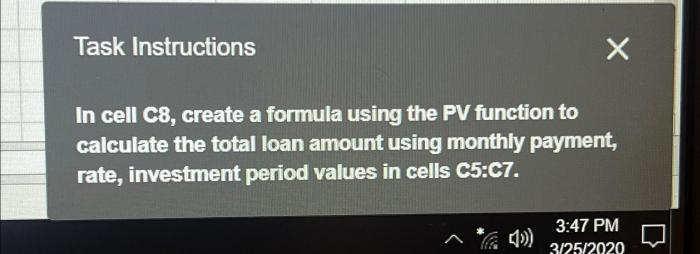

To create a formula using the PV function in cell C8, follow these steps:

- Click on cell C8.

- Type the following formula:

=PV(rate, nper, pmt, [fv], [type]) - Replace the placeholders with the appropriate values:

rate: The annual interest rate.nper: The total number of periods.pmt: The periodic payment.fv: (Optional) The future value.type: (Optional) The type of annuity. 0 for end-of-period payments, 1 for beginning-of-period payments.- Press Enter.

Formula Parameters

The PV function takes the following parameters:

rate: The annual interest rate. This is the discount rate used to calculate the present value.nper: The total number of periods. This is the number of cash flows that will be received or paid.pmt: The periodic payment. This is the amount of each cash flow.fv: (Optional) The future value. This is the value of the investment or loan at the end of the last period.type: (Optional) The type of annuity. 0 for end-of-period payments, 1 for beginning-of-period payments.

Practical Applications

The PV function has numerous practical applications in financial analysis, including:

- Calculating the present value of an investment to determine its current worth.

- Determining the present value of a loan to compare different loan options.

- Calculating the present value of an annuity to determine the total value of a series of regular payments.

Considerations and Limitations

When using the PV function, it is important to consider the following:

- The PV function assumes that the cash flows are received or paid at the end of each period.

- The PV function does not account for inflation or other factors that may affect the value of the cash flows over time.

- The PV function is limited to calculating the present value of a single series of cash flows.

FAQ Corner

What is the purpose of the PV function?

The PV function calculates the present value of an investment, loan, or annuity, providing insights into the current worth of future cash flows.

What arguments does the PV function require?

The PV function requires the rate of return, number of periods, and a series of future cash flows as arguments.

How do I create a formula using the PV function in cell C8?

In cell C8, enter the formula “=PV(rate, nper, values)”, where “rate” represents the rate of return, “nper” represents the number of periods, and “values” represents the range of future cash flows.